Depreciation calculator income tax

D i C R i. 35000 - 10000 5.

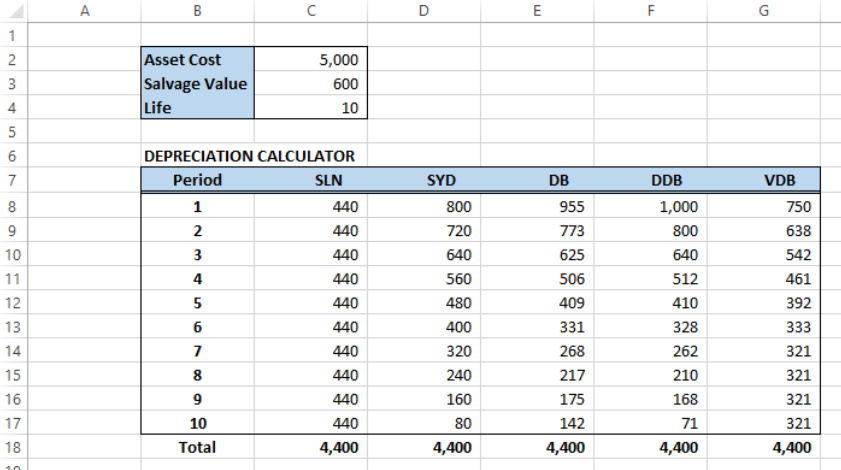

Accumulated Depreciation Formula Calculator With Excel Template

Amount on which additional depreciation is to be claimed in the previous year at Full Rate.

. 35000 - 10000 5 5000. Tax on Income from Pension and Family pension in India. This is the current tax depreciation rules in the USA.

To recover the carrying amount of Rs 100 the entity must earn taxable income of Rs 100 but. Addition for a period of less than 180 days in the previous year. 100 Accurate Calculations Guaranteed.

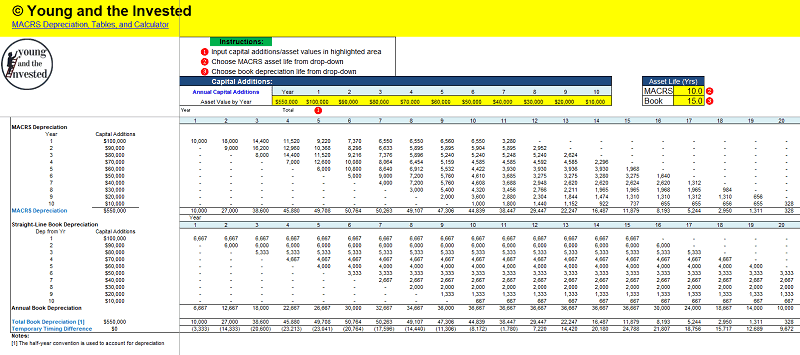

Calculate depreciation for a business asset using either the diminishing value. The MACRS Depreciation Calculator uses the following basic formula. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed.

You can use this tool to. MACRS Depreciation Calculator Help. It is free to use requires only a minute or two and is relatively accurate.

Discover Helpful Information And Resources On Taxes From AARP. For eg if an asset. This can be used as.

Where an asset acquired during the previous year is put to use for less than 180 days in that year the amount. Request A Demo Today. By using the formula for the straight-line method the annual depreciation is calculated as.

Where Di is the depreciation in year i. Depreciation rate finder and calculator. Depreciation on Straight Line Method SLM is not.

See it In Action. Depreciation can be claimed at lower rate as per income tax act. Above is the best source of help.

Under this system a fixed percentage of the diminishing value of the asset is written off each year so as to reduce the asset to its. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Addition for a period of 180 days or more in the previous year.

This means the van depreciates at a rate of. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Use ClearTax Depreciation calculator to calculate depreciation in both Straight Line Method SLM and Written Down Value Method WDV. Under this system depreciation can be calculated using the declining balance method or the straight line method. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

C is the original purchase price or basis of an asset. Reduce Risk Drive Efficiency. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Depreciation is allowable as expense in Income Tax Act 1961 on basis of block of assets on Written Down Value WDV method. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Find the depreciation rate for a business asset.

Bonus depreciation has different meanings to. Ad Try Our Free And Simple Tax Refund Calculator. Section 179 deduction dollar limits.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. 157 rows Cost of Rs 150 less cumulative tax depreciation of Rs 90 ie. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

The bonus depreciation calculator is on the right side of the page. Depreciation per year Book value Depreciation rate. This limit is reduced by the amount by which the cost of.

Consideration or other realization during the previous year out of addition for a period of less than 180 days. Just upload your form.

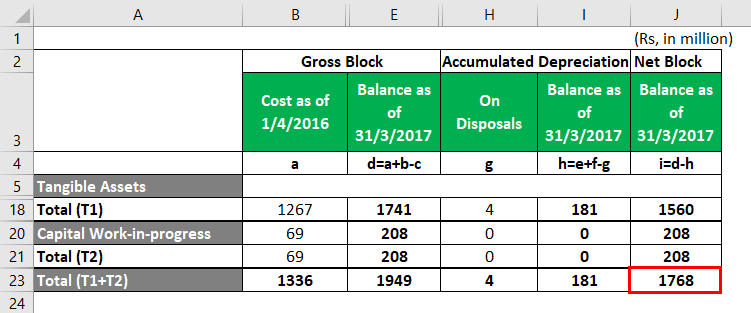

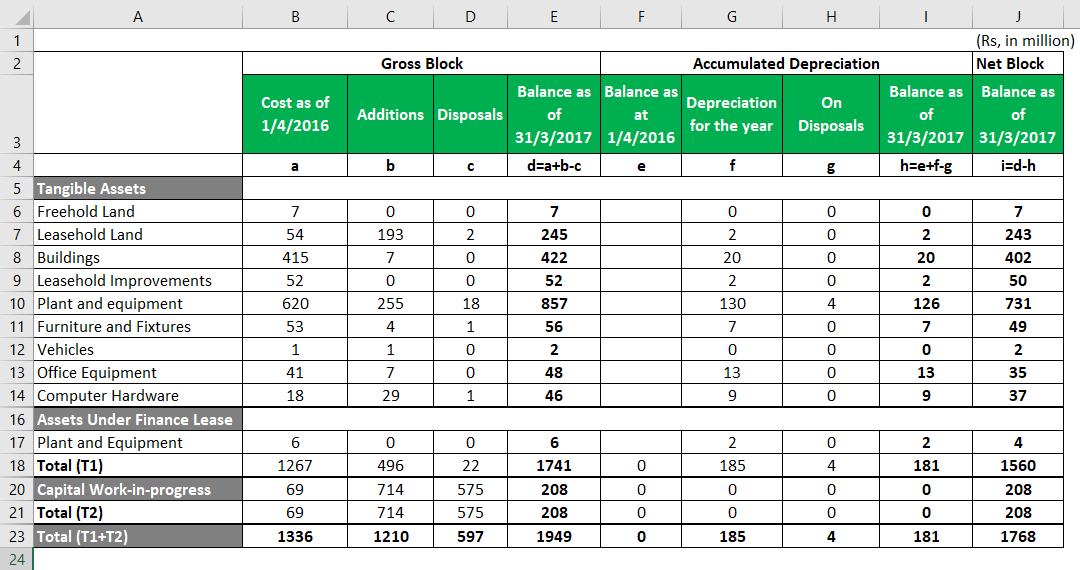

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Macrs Depreciation Table Calculator The Complete Guide

Free Macrs Depreciation Calculator For Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation What Is The Depreciation Expense

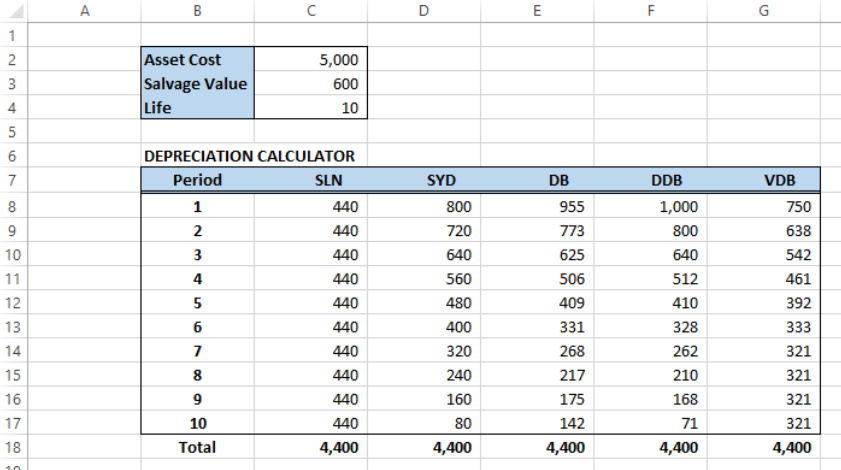

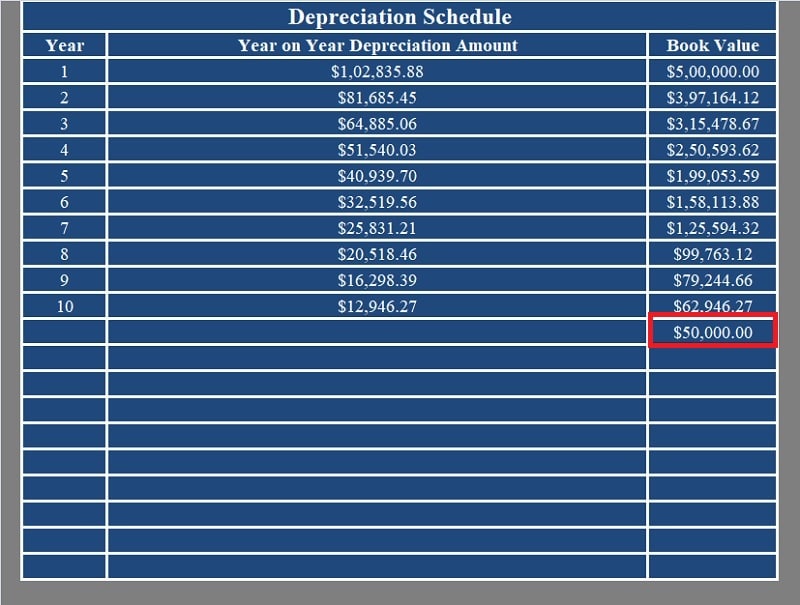

Depreciation Formula Examples With Excel Template

Depreciation Tax Shield Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation In Excel Excelchat Excelchat

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Template For Straight Line And Declining Balance

Guide To The Macrs Depreciation Method Chamber Of Commerce